eToro Review 2025: Is It A Trustworthy Broker?

eToro Overviews

eToro is a popular social trading platform that provides investors with access to a wide range of financial markets, including stocks, commodities, indices, and currencies. The platform has become increasingly popular due to its focus on social trading, allowing investors to interact, share ideas and insights, and replicate each other's trades. Let's look at this broker in more detail to see why they are so popular.

eToro is a popular social trading platform that provides investors with access to a wide range of financial markets, including stocks, commodities, indices, and currencies. The platform has become increasingly popular due to its focus on social trading, allowing investors to interact, share ideas and insights, and replicate each other’s trades.

eToro was founded in 2006 and is headquartered in Tel Aviv, Israel. The platform has grown rapidly in recent years and now boasts more than 11 million registered users in over 140 countries. It is also fully regulated by top-tier financial authorities, including the FCA in the UK and the CySEC in Cyprus.

One of the key benefits of eToro is its user-friendly platform, which is designed to be accessible to traders of all levels of experience. Whether you’re a beginner or a seasoned trader, you’ll be able to use the platform to access the financial markets, research investment opportunities, and make trades with ease.

One of the standout features of eToro is its social trading network, which allows investors to connect with each other and share information about the markets. Investors can follow each other’s portfolios, discuss strategies and ideas, and even copy each other’s trades. This allows traders to benefit from the collective knowledge and experience of a community of like-minded individuals.

eToro also offers a range of tools and resources to help traders make informed investment decisions. This includes a comprehensive news section, detailed market analysis, and a range of investment products, including stocks, commodities, and ETFs. Let’s look at this broker in more detail to see why they are so popular.

| Broker Feature | Overview |

| Type of Broker | CFD Broker |

| Regulation & Licensing | · Australian Securities and Investments Commission (ASIC) · Cyprus Securities and Exchange Commission (CySEC) · Financial Services Authority of Seychelles (FSA) · Financial Conduct Authority (FCA) |

| Applicable Countries Allowed To Trade | Link to all applicable countries |

| Assets Offered | Forex, stocks, commodities, indices, crypto, ETFs |

| Platforms Available | eToro Web and Mobile Platforms |

| Mobile Compatibility | Yes |

| Payment & Withdrawal Options

| · Skrill · Debit and credit card · Neteller · PayPal · eToro Money · Trusty Online Banking · Bank Transfer |

Pros and Cons

- Easy-to-use platforms

- Very beginner friendly

- Able to trade CFDs

- Adjustable leverage per trade

- One account to suit everyone (great for beginners)

- Great trading resources

- Very popular platform

- Have over 11 million users

- Customer support is only through tickets

- You can only trade CFDs

- Spreads are not great

- Only one account, so you don't have flexibility

Is eToro Safe? Broker Regulations

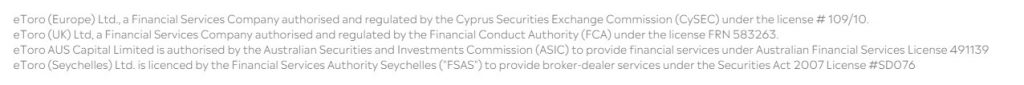

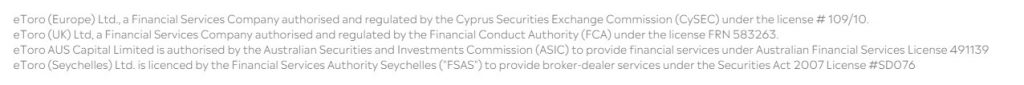

eToro is overseen by four financial regulatory commissions across the globe due to them operating internationally and in various regions. Most importantly, more authorities overseeing a broker is a good thing. This means that, in most cases, they are more reputable and can be regarded as a safer option to brokers who are not as regulated.

In the case of eToro, they are regulated by two top-tier authorities, the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC). Then they are also regulated by the Financial Conduct Authority (FCA) in the UK and lastly, by the Financial Services Authority of Seychelles (FSA).

You can find the information on their regulations by heading to their website and then scrolling to the footer section where the various entities are listed along with their regulators and their license number;

- eToro (Europe) Ltd is a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license # 109/10.

- eToro (UK) Ltd is a Financial Services Company authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

- eToro AUS Capital Limited is authorized by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139

- eToro (Seychelles) Ltd. is licensed by the Financial Services Authority Seychelles (“FSAS”) to provide broker-dealer services under the Securities Act 2007 License #SD076

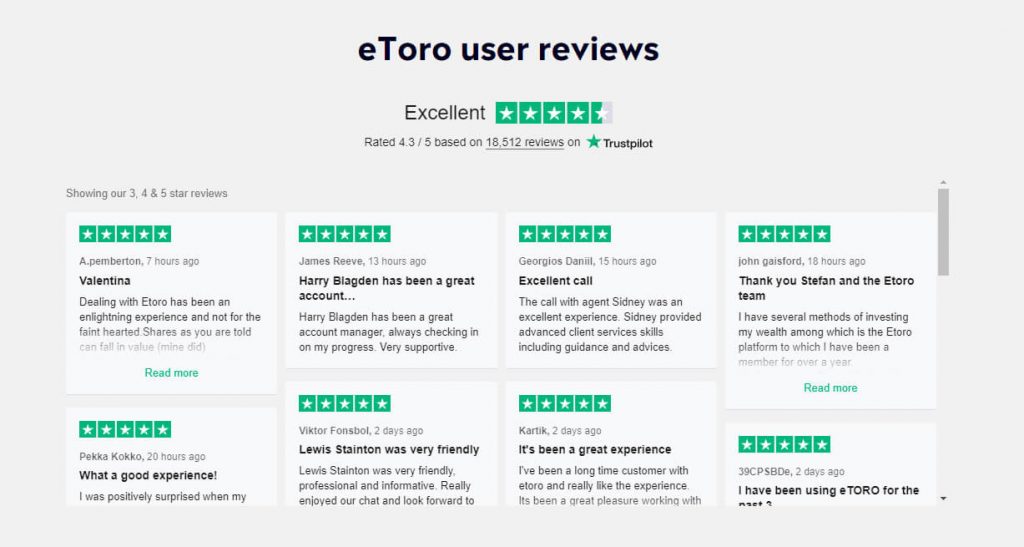

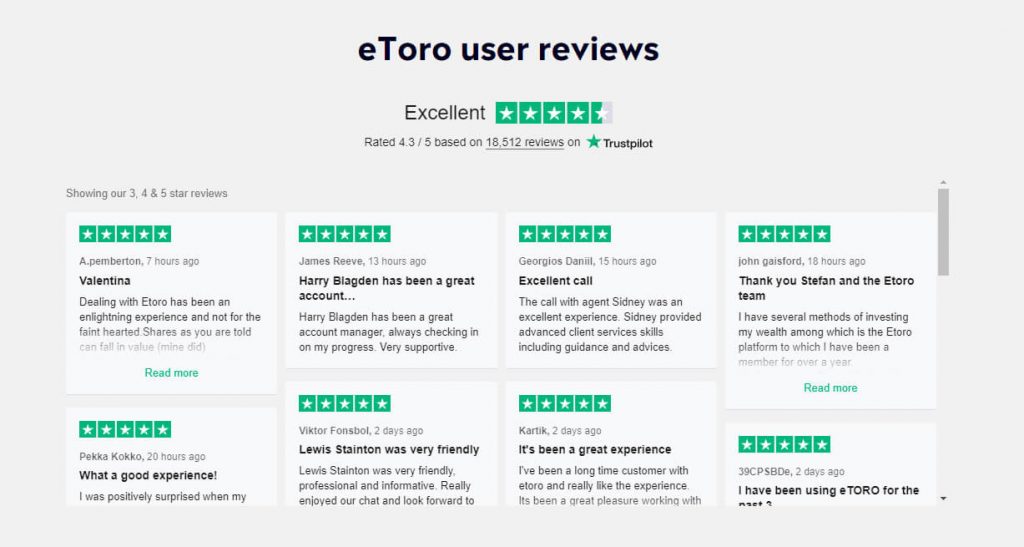

In terms of awards, they have been nominated for having the best affiliate program by “forex-awards.”. If you would like to consider customer reviews in determining a broker’s legitimacy, you can also look at Trustpilot. In fact, eToro has its reviews embedded in its website. Clients give this broker a 4.3-star rating out of a possible five and this is based on nearly 19,000 customer reviews.

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority of Seychelles (FSA)

- Financial Conduct Authority (FCA)

What Can I Trade with eToro?

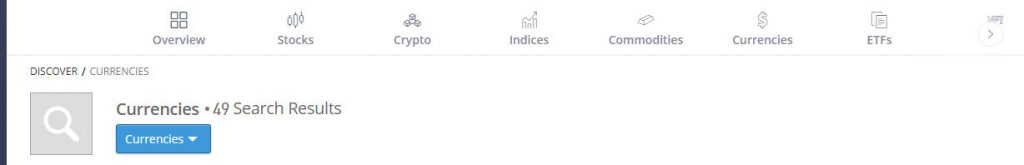

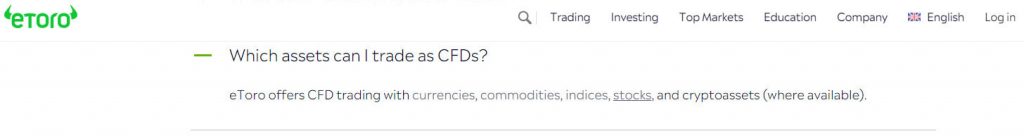

eToro deals in CFD trading for forex, stocks, commodities, indices, and crypto. They don’t give much detail on the number of assets offered, and you won’t find this information on their site. You will need to open up the actual market quotes page for each, and then you will be able to tell how many instruments for each asset class are available. Luckily enough, we have done this for you.

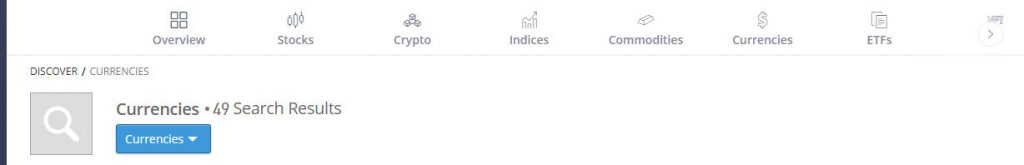

Forex

Heading to the quotes section of the eToro site for forex, we can see that they offer 49 currency pairs. You can expect to find all the typical major and minor pairs, along with some exotics. The assets list for forex is not that large in this case, but it does cover what traders usually deal with.

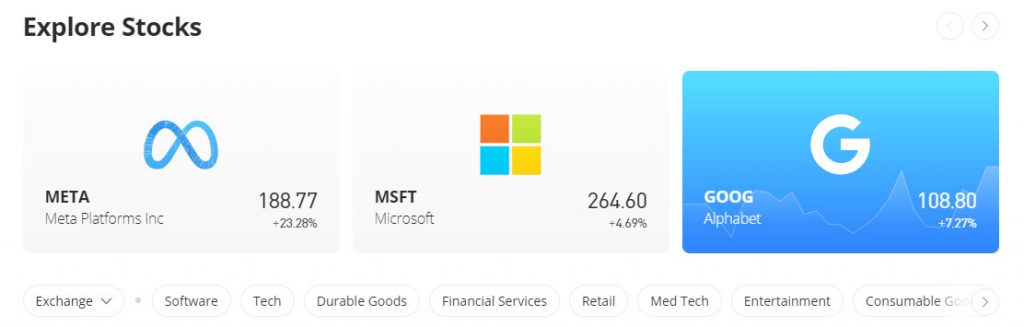

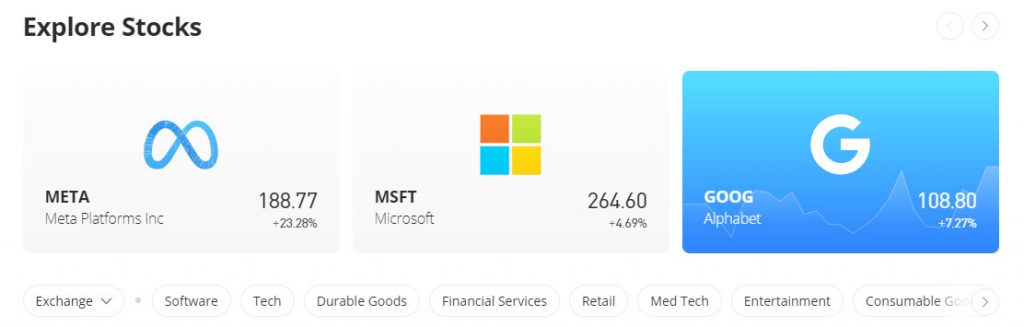

Stocks

In the case of stocks, this broker does not give a fixed number at all. As such, we can’t speculate on how many stocks they offer as tradable CFDs. However, the most popular stocks, like Meta, Amazon, Google, etc., can be found.

Commodities

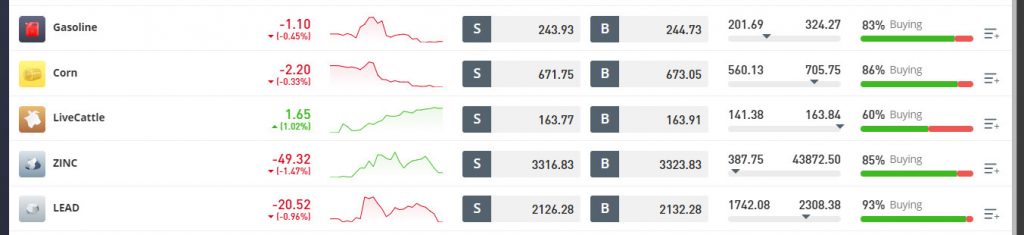

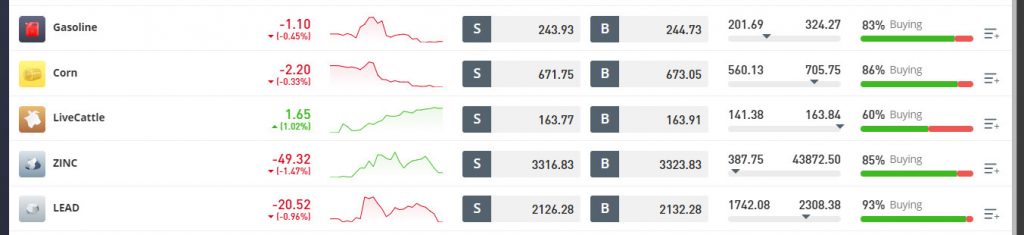

Clients will be able to trade or copy trade (we will discuss this) 26 various commodities, including metals, energies, and staples. This includes wheat, oil, gold, silver, natural gas, etc. You are even able to trade LiveCattle through this broker.

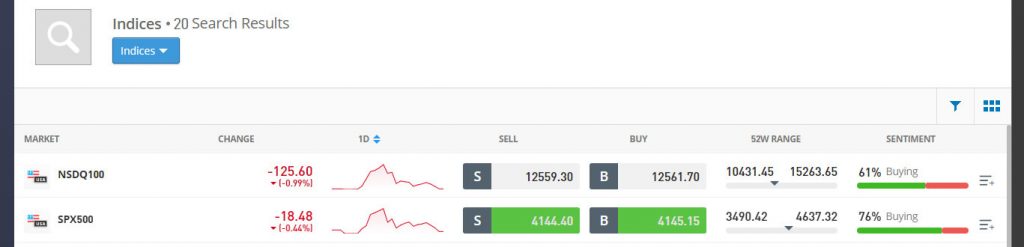

Indices

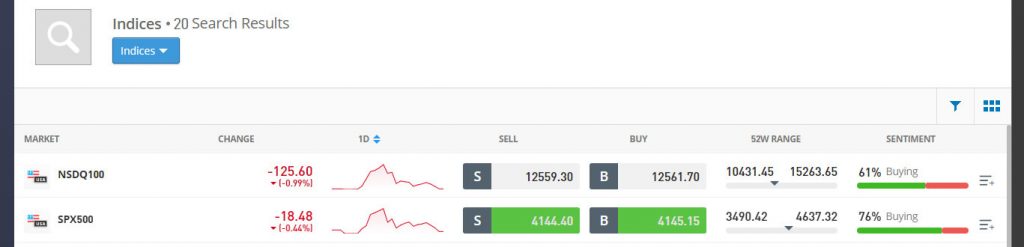

The quotes page for indices pulls up 20 of the most popular indices that track companies across the globe. Here you can expect to find everything from the DAX to the Hang Seng, not to mention the S&P and the FTSE 100.

Crypto

When it comes to crypto, eToro has 57 different coins that you can trade 24/7. Remember that crypto trading is not like forex, and the markets for this asset class do not ever close. All the popular coins can be found here, along with emerging ones.

ETFs

Lastly, eToro also has numerous ETFs that traders can take positions on. Remember that ETFs can be considered similar to an investment pool that operates like a mutual fund. eToro lets you trade these as CFDs, and you will be able to find 300 various “baskets” tracking various sectors of many economies.

- Cryptocurrency

- Stocks

- Forex

- Commodities

- Indices

- ETFs

How to Trade with eToro?

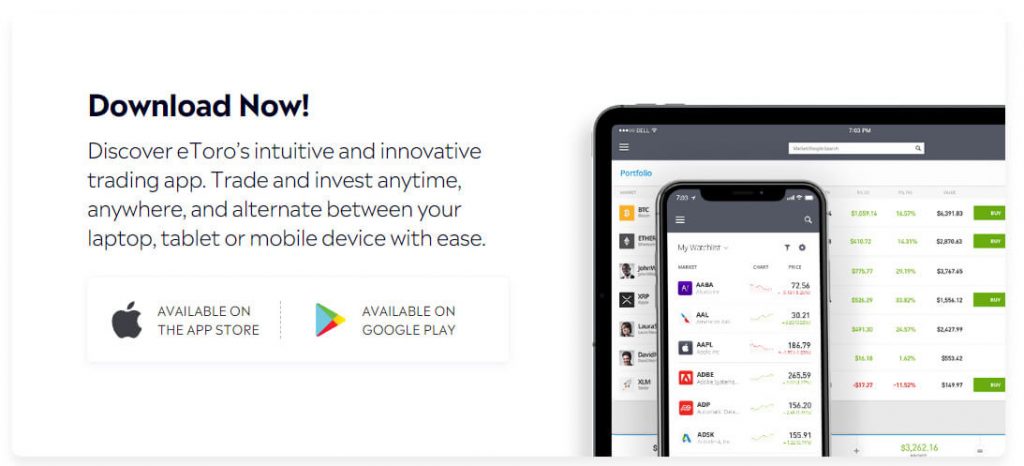

There are only two ways to trade through eToro: their mobile app or their web platform, which can be logged into as long as your device has browser compatibility. eToro is unlike other brokers that use MetaTrader; in some cases, this might not be a bad thing. Nowadays, logging onto a web-based platform is much easier than needing a desktop machine to download and install a program.

However, top-tier brokers (most of them) use MetaTrader for a reason. This is because it has been considered to be the industry standard since its release in 2005. The features and services in MetaTrader are “bar none,” some of the best that any trading software offers.

The web platform that eToro has is sleek and well-designed, but it is essential to understand that this broker’s platform is really geared toward beginner investors and copy traders.

You then have their mobile app, specifically designed around the web platform, and you will be able to trade using it just as you would with the web terminal. That is to say; it still includes copy and social trading features.

It should be noted that not much information with regard to either platform is given, and the broker has CTA for clients to signup and experience the software for themselves. This is quite a good marketing strategy, but clients who know what they want in their trading platforms will first need to sign up to get the full experience.

| Feature | eToro Web Platform | eToro Mobile App |

| One-Click or One-Tap Trading | Yes | Yes |

| Trade Straight off Charts | Yes | Yes |

| Email Alerts or Push Notifications | Yes | Yes |

| Mobile Alerts | Yes | Yes |

| Stop Order | No | No |

| Market Order | Yes | Yes |

| Trailing Stop Order | No | No |

| OCO Orders (One-Cancels-The-Other) | No | No |

| Limit Order | No | No |

| 24hr trading | Yes | |

| Charting Package | No | No |

| Streaming News Feed | No | No |

- eToro Web Platform

- eToro Mobile App

How Can I Open eToro Account? A Simple Tutorial

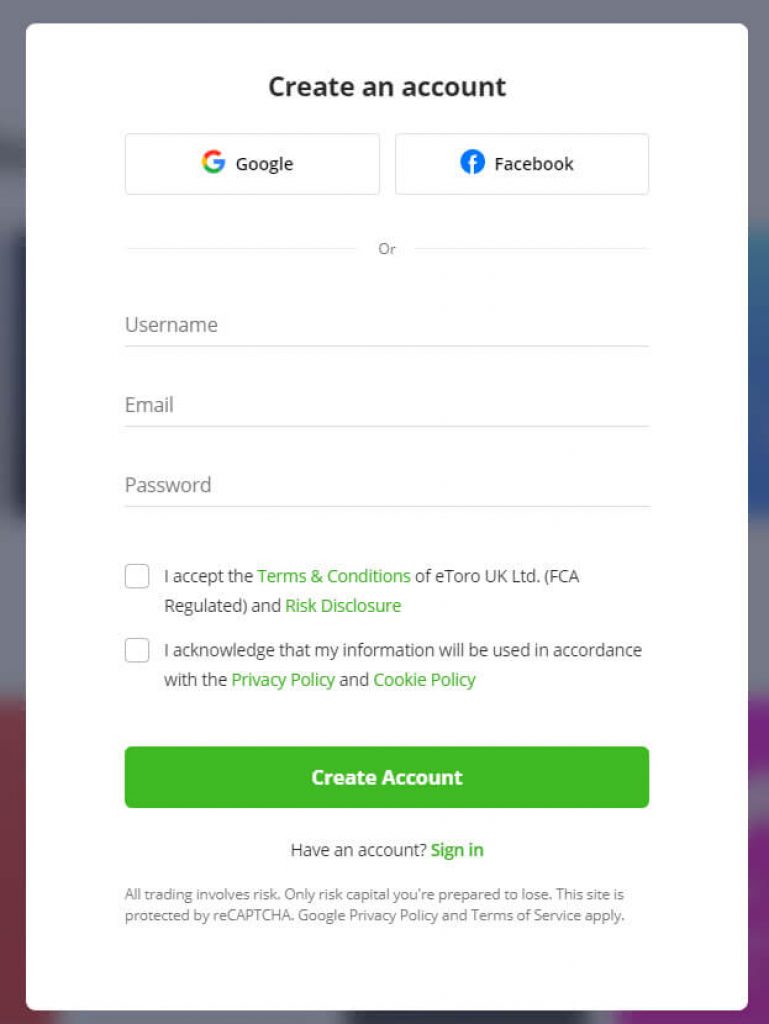

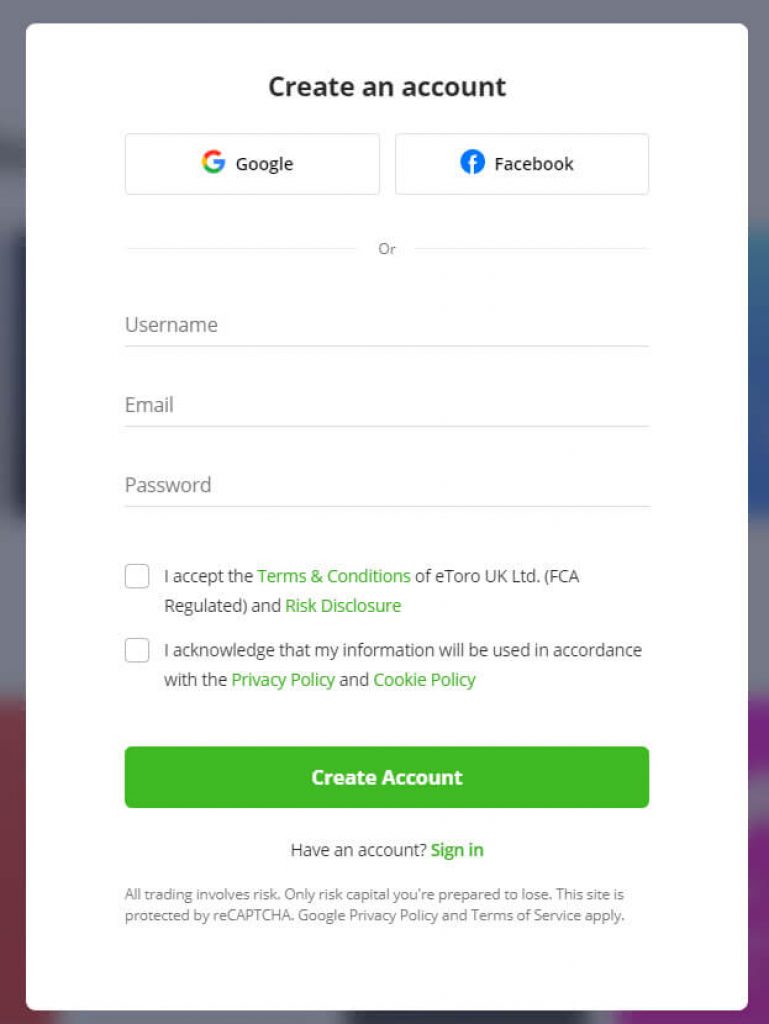

eToro has made registration very easy indeed, and heading to their official site; you will be prompted with a “start investing” CTA straight away.

If you decide to navigate their site, you will need to click on the “sign up” button on the right side of the main menu. Either way, both links will redirect you to the same registration page.

![]()

Once you are redirected to the registration page, you will need to fill in your username, Email, and password and accept all their terms and conditions. If you intend to signup with this broker, then it is in your best interest to read through these documents.

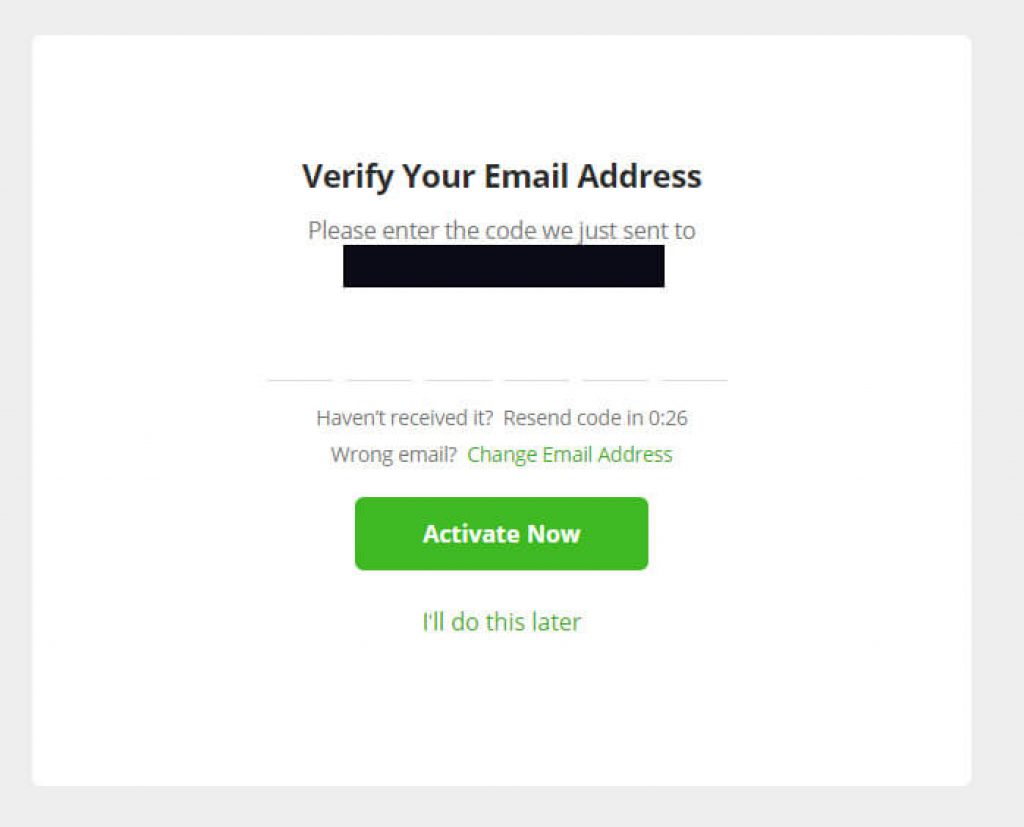

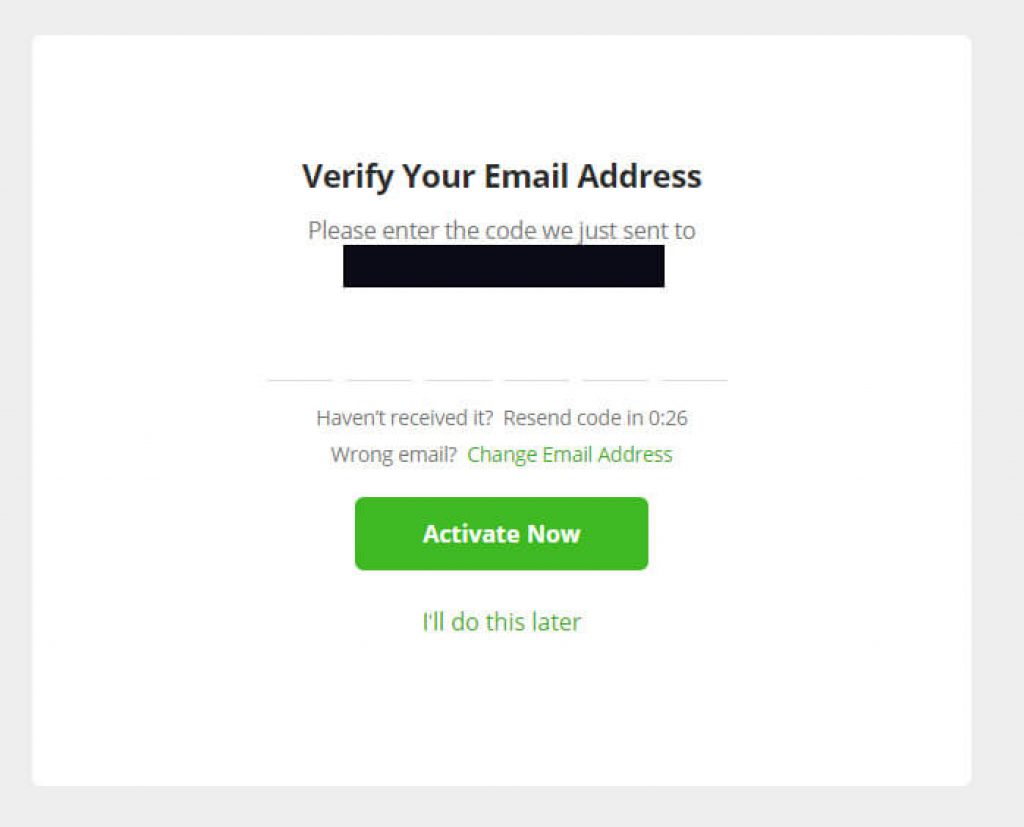

You also have the option to sign up through Google or Facebook if you so choose. For the purposes of this tutorial, we will sign up with an Email account to show you the proceeding steps. After inputting your details, you will then be directed to another screen where you will need to verify your Email.

After you have inserted the verification code and clicked on “activate now,” your registration process will be complete, and you will be taken to the client dashboard area, where you will have access to your account.

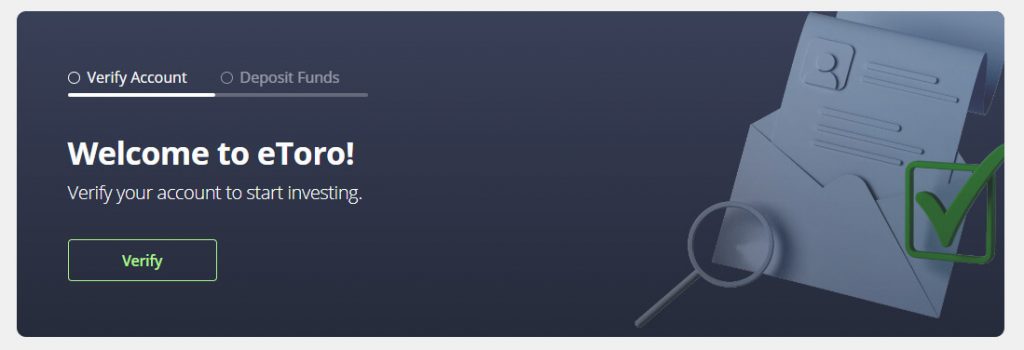

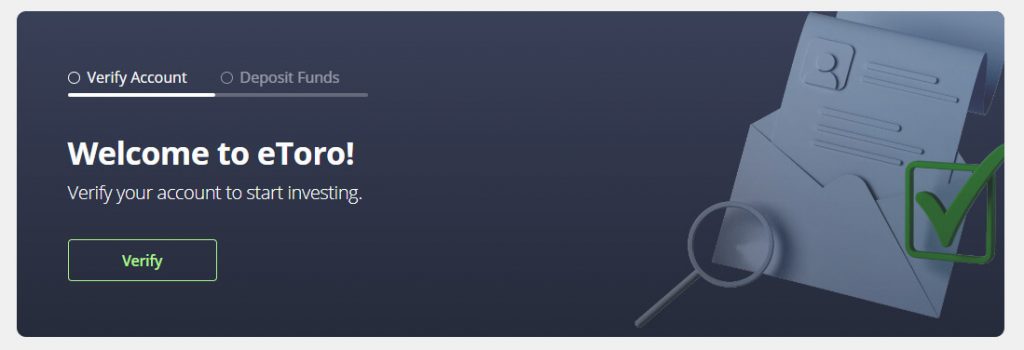

At this stage, even though the registration process is complete, you will need to verify your account, and that involves you submitting verified documents such as your ID, proof of address, and banking details. If you plan to deposit and start trading, you will have to do this.

- Head to the eToro website

- Click on the CTA on the home page, or if browsing the site, click on the "sign up" button

- Fill in your Email, username, and password to register or register via Google or Facebook

- Verify your email account if you signed up with credentials

- Log into your eToro client dashboard

- Verify your account to deposit, trade, and withdraw funds

eToro Charts and Analysis

eToro has its trading resources and education material neatly stacked under the menu heading of “education,” which is aptly named. Trading resources and education when it comes to beginner investors is a must for international online brokers. It gives beginner traders a reason to trust and remain on the platform and provides clout to the broker while helping new traders and investors learn the ropes.

There are four sections that cover eToro’s trading resources, and they are;

- News and Analysis

- eToro Academy

- eToro Plus

- Digest and Invest

The “news and analysis” section is your typical blog that is updated almost daily, and you can find relevant news impacting the markets here. They also have articles dedicated to “weekly roundup” and ones on crypto and forex can also be found. The topics that you have available as a filter include, CopyTrader, Crypto, Investing, Market Insights, Stocks, Trading, eToro Money, and a few others.

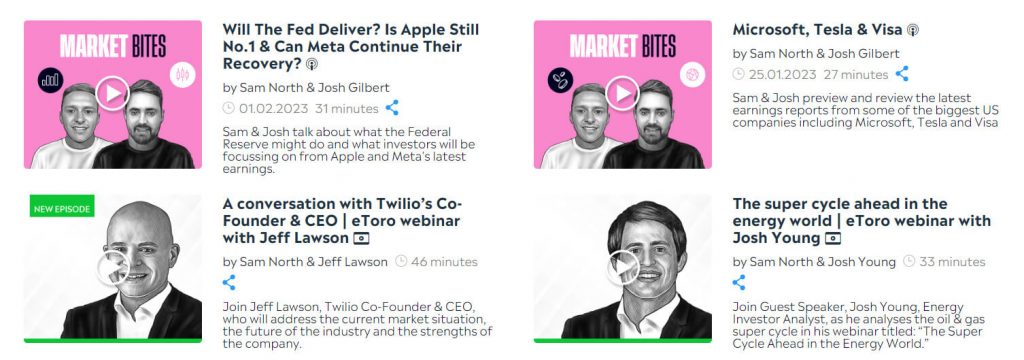

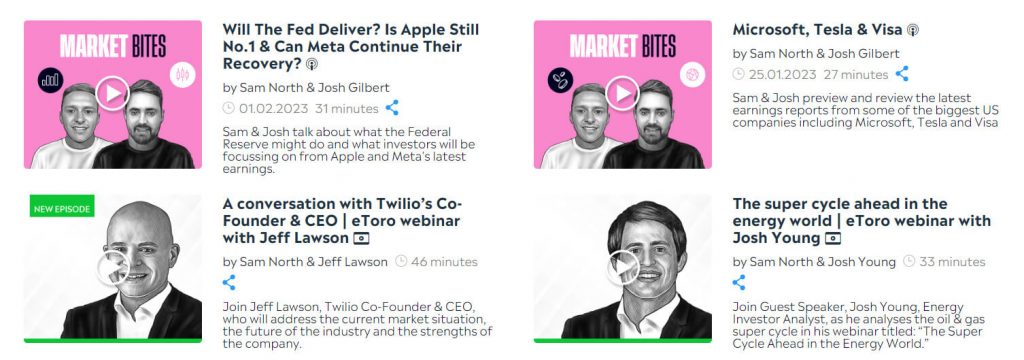

Next is the eToro Academy, and this is something anybody would want to take a look at. Whether you are new to trading or a seasoned pro, whether you use the broker or not, the Academy section is filled with hundreds of videos, podcasts, and webinars covering most aspects of trading and the financial markets. Guides, basic concepts, and summer school are just some topics that this Academy covers.

It is truly one of the better Academy sections that a broker has provided, and best of all, all the content is absolutely free, and there are no hidden signup costs, fees, or “gotcha” situations here.

eToro plus is a section dedicated to weekly and quarterly summaries that dive into market trends and where you should go if you need a catchup of an overall picture of the markets and what has been occurring.

It is a great “blog” to get a nice roundup on the overall feel of the markets. Ben Laidler is the economic specialist here, and most topics will be covered and written by him. Everything from “natural gas impact” to “covid still driving the markets” can be found here.

The last section of trading resources you will find is the “digest and invest” section, where much like the blog and eToro plus section, you will find videos from experts covering different aspects of the markets. This section can be compared to a “Bloomberg” news feed where interviews can take place, insights into specific sectors, and general overviews are shared.

- News and Analysis

- eToro Academy

- eToro Plus

- Digest and Invest

eToro Account Types

Many brokers have different account types that will differ from each other. This is because trading is not just straightforward, and many individuals require different accounts for specific trading styles. For example, some brokers have “Cent” accounts that allow you to trade at fractional values, helping you test strategies. You also sometimes get “ECN” accounts or “Zero Spread” accounts where spreads for specific forex pairs will start at 0. Though these accounts usually have a commission-based approach.

With eToro, there is only one account. Moreover, they don’t even have a name for it, so it is just considered the standard account that anyone who signs up for the platform will have. This makes things a lot easier for new traders because deciding which account suits your situation best is not typically known unless you have experience with trading.

With eToro, one account fits all. You should also remember that this broker only trades in CFDs. This means the futures, options, and shares are not available. Also, the platform and the broker generally are based on copy and social trading, especially catering to new traders. This means that one account is perfectly suited for everyone, and nothing special is required.

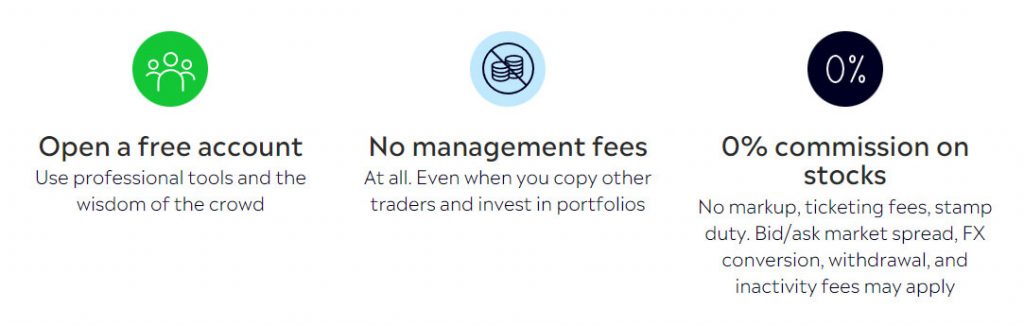

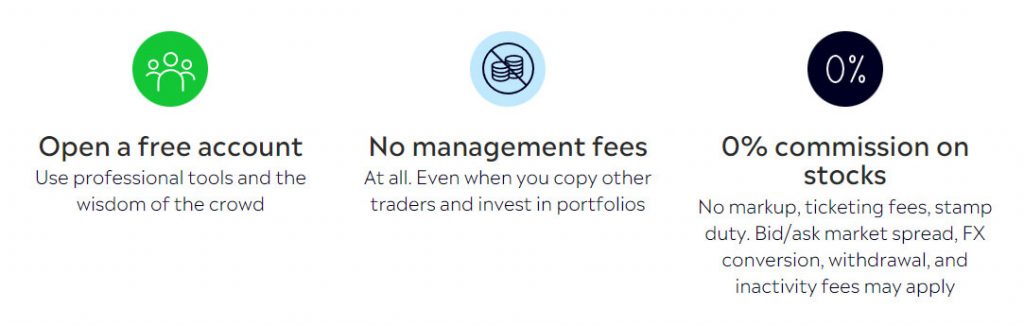

Take note that many brokers also charge fees. This can be for different aspects that take into account the broker’s various features—for example, inactive account fees or deposit and withdrawal fees. In the case of eToro, there are no fees or hidden fees.

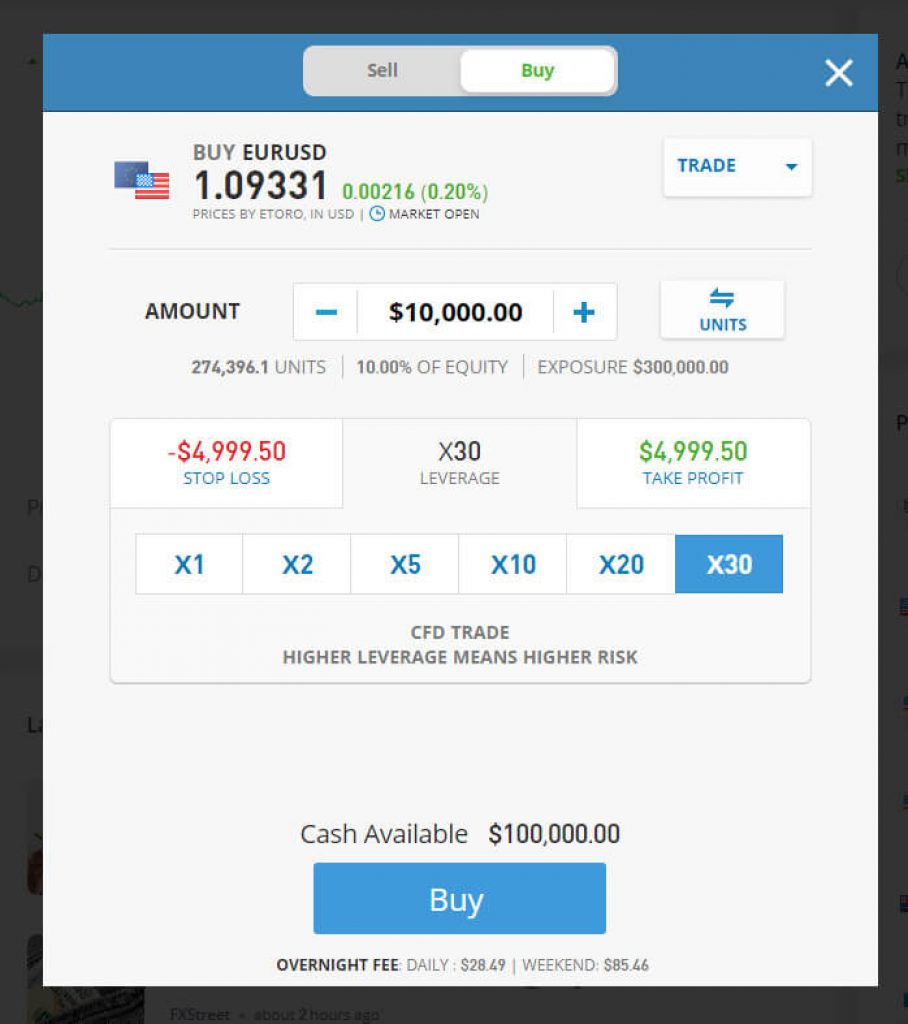

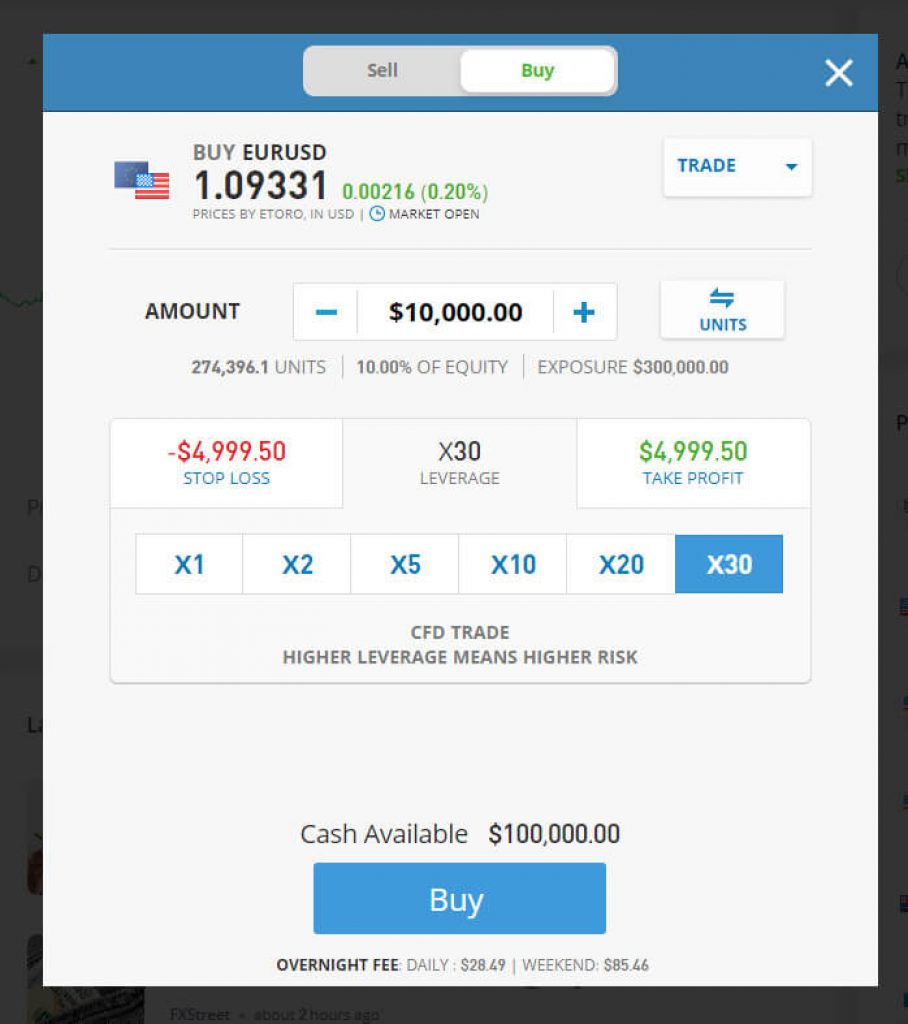

However, there are some things to note about the account. The leverage is variable, and for indices, it goes up to 1:20. For forex, the leverage is 1:30. Spreads are not specifically given in pip form because the platform does not show this type of information. Remember, it is again suited toward ease of use for beginner traders. For any additional information on specific assets, you will need to open an account; go to the asset and click on the “invest” button to see all available options. Lastly, the minimum deposit to trade on the account is 50 USD for most countries, but it will vary depending on what country you are in.

| CFD Broker | Standard account |

| Features | One account for all traders |

| Account Currencies | USD, GBP, EUR |

| Available Leverage | Varied |

| Minimum Deposit | 50 USD |

| Commission Per Trade | N/A |

| Decimal Pricing | N/A |

| Trading Instruments | Forex, stocks, commodities, indices, crypto, ETFs |

| Min. Lot Size Per Trade | N/A |

| Max. Lot Size Per Trade | N/A |

| Spreads | Varied |

| Demo Account | Yes |

| Swap/Rollover Free | Yes |

| Hedging | No |

| Scalping | Yes |

| Copy Trading Support | Yes |

| Available to US Residents | Yes (bitcoin) |

- Standard account (For all traders)

Do I Have Negative Balance Protection with This Broker?

In the event that your equity becomes negative, eToro will implement a margin call and close your position(s). They will then absorb any loss that you may have incurred and reset your balance to zero. This means that you can never lose more than what you deposited into your account.

This information regarding this policy that eToro has can be found here. Additionally, this is a good policy to have and is standard when it comes to many international (especially the “famous”) brokers. This helps to incentivize potential clients to have less stress when trading and learning how to do so. Thinking that your account could go into the negative and cost you thousands of dollars if you do not know what you are doing is a huge “barrier to entry” for many individuals.

- Yes, they offer negative balance protection

eToro Deposits and Withdrawals

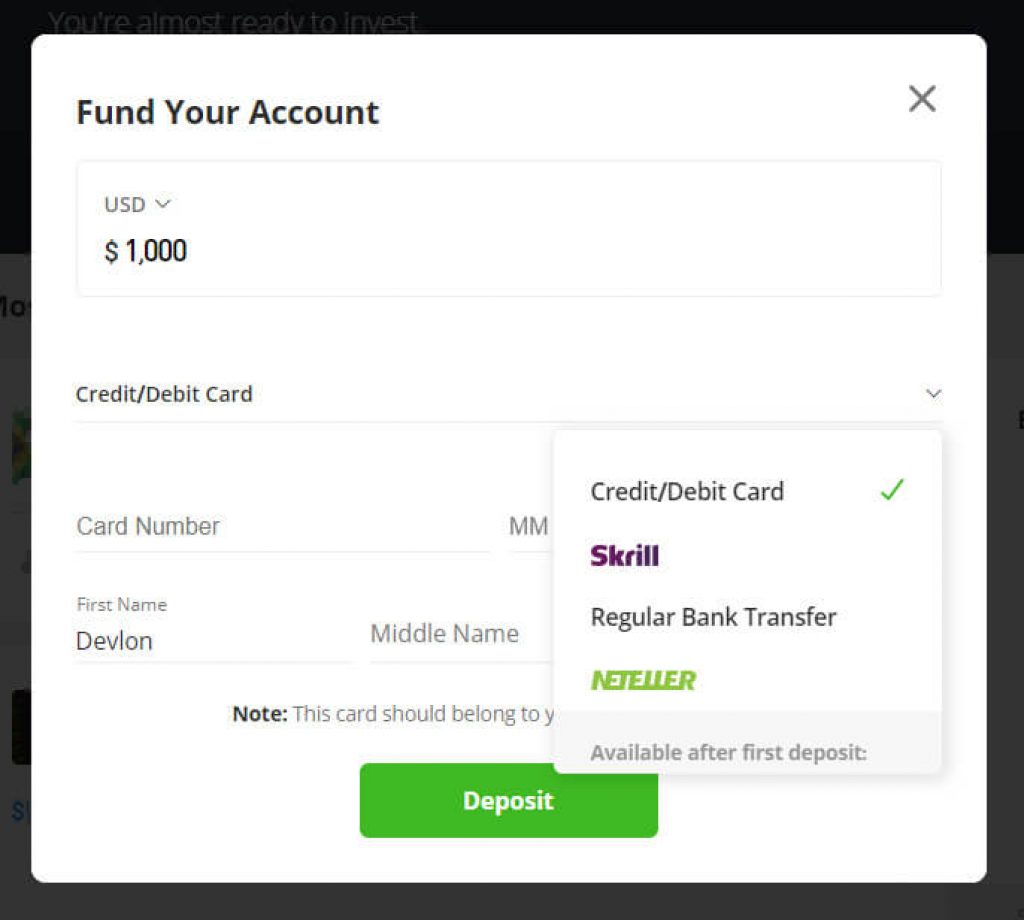

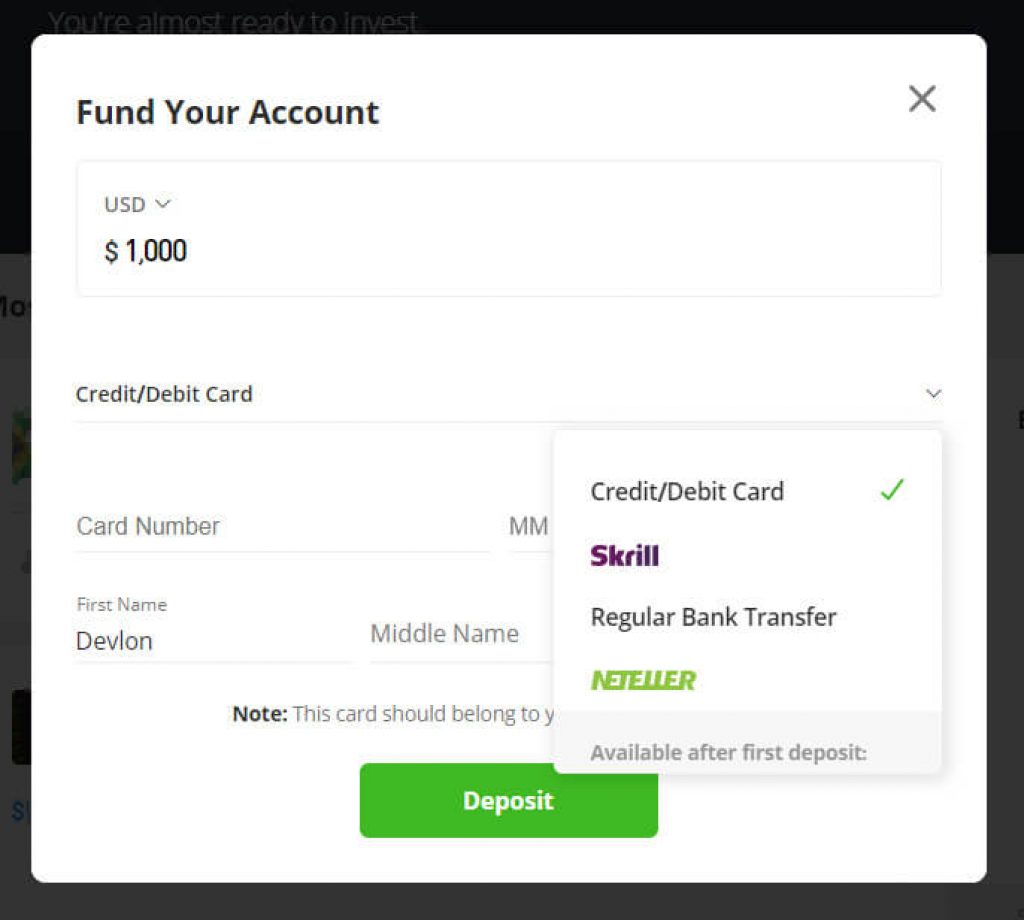

There are a few options when it comes to depositing funds into your account in terms of methods. eToro offer;

- Credit Card or Debit Card

- Bank Transfer

- Klarna/Sofort

- E-wallet (PayPal, Skrill, Neteller)

- eToro Money

- Trusty Online Banking

Remember that to deposit, you will first need to verify your account after registering. Once you have done this then, you will be able to deposit funds via the client dashboard. Also, not that PayPal deposits will become available after your initial deposit via another method.

One thing to note (and that we discussed) is that the minimum deposit for most countries is 50 USD, but this will change depending on your region. Reference the image below for a full breakdown. This is what you will be expected to deposit as a minimum, depending on your region.

The methods for withdrawing are the same as for depositing, and you will find this option which is also located in your client dashboard in the menu.

Remember that we touched on the fact that eToro has no account fees and also none for depositing and withdrawals. This is also a policy that most brokers incorporate. However, some use marketing to push it across as a promotional offer when it is considered to be standard practice by most brokers.

- The minimum deposit for the eToro trading account is: 50 USD

- Skrill

- Debit and credit card

- Neteller

- PayPal

- eToro Money

- Trusty Online Banking

- Bank Transfer

Support Service for Customer

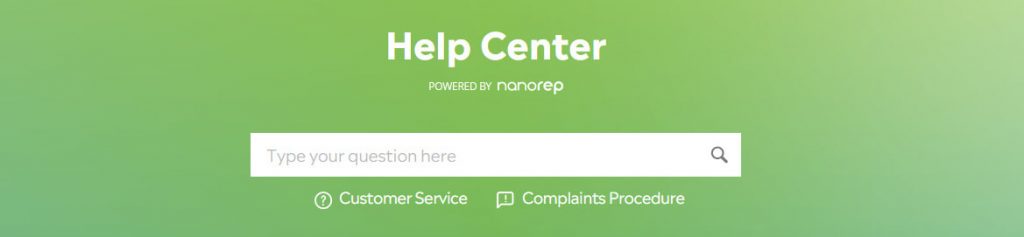

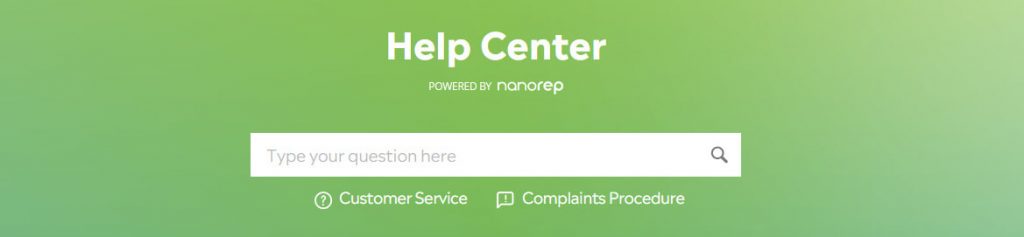

eToro is not known for its customer support. However, it comes in the form of a help center whereby you can open a ticket as a new or existing customer. You can find the Help Center by going through the menu or by scrolling down to the footer section.

To open a ticket, you must head to the Help Center and click on the “customer service” link. You will then be redirected to a new page where you will be able to open a new support ticket.

Besides the Help Center, which is filled with a pretty comprehensive FAQ section, there is no other channel that you can take to reach customer support. Typically, more reputable brokers will have many support forms, including live chat, telephone, Email, contact forms, and more.

eToro lacks heavily in the customer support field, and we have not experienced any problems thus far with the broker, so we cannot tell what the turnaround time for a ticket to get resolved is.

| eToro Customer Support | Overview |

| Supported Languages | English, Hebrew, and Spanish |

| Customer Service By | eToro |

| Customer Service Hours | Unknown |

| Email Response Time | N/A |

| Telephonic Support | No |

| Personal Account Manager | No |

- Supported Languages: English, Hebrew, and Spanish

- Customer Service Channels: Help Center FAQs, Ticket

- Customer Service Hours: Unknown

Prohibited Countries: Where Can I Not Trade with this Broker?

The list of countries that are not allowed to use eToro is extensive and too long to list here. Due to many reasons, a broker might not be allowed to operate in specific regions. This means that if you are part of their “blocked” countries list, you will not be allowed to use the broker and trade. However, you can find information on blocked countries here.

Additionally, you can find information on if your country is supported by eToro here. Remember, the laws, regulations, and sanctions play a big role in whether or not a broker will support a region, so this is one of the first things you will need to consider when looking for one.

It will be a pity to go through dozens of brokers trying to find one that you prefer just to find out that the broker you choose is not allowed to operate in your region.

- To many to mention, refer to the link above

Special Offers for Customers

eToro, for the most part, does not offer any added bonuses or special promotions when you sign up with them. In many other cases, various brokers will offer an array of special promotions in terms of welcome bonuses, loyalty programs, IB programs, customer rewards, giveaways, and so on. eToro has nothing like this.

The only aspect of a promotion they have is a referral link that you can send to your friends and family, and they can use it to sign up with the broker. However, there will usually be some incentives like a rebate or a fixed fee if they join and sign up. eToro does not have this. They only provide you with a referral link and no information on any compensation that you may receive.

However, you will have to consider that eToro is mainly a copy trading platform with no fees. This means that there are no signup fees or any fees for depositing and withdrawing. Moreover, they don’t take a commission when you copy another trader’s portfolio.

Essentially this means that you could copy an investor that is seeing a 300% return, and with the click of a button, you will be following and entering all his positions. In a way, this does seem like a “special promotion” in itself.

- No special offers

- Copy Trading Platform

eToro Review Conclusion

eToro has been in operation since 2006 and has 11 million users worldwide. Multiple financial authorities also regulate them across the globe. Also, they have almost 15,000 positive reviews on Trustpilot.

PIPPENGUIN

eToro has been in operation since 2006 and has 11 million users worldwide. Multiple financial authorities also regulate them across the globe. Also, they have almost 15,000 positive reviews on Trustpilot.

Taking these factors into account and considering all the other points we put across in this article, we would have to say that eToro is a legitimate and safe broker. Due to their “popularity,” they may sometimes get backlash, but this is something to be expected of a broker this size.

Summary and Key Takeaways

The eToro platform is simple and easy to use. This goes for both the web and mobile platforms. The entire broker is geared toward beginner traders and mainly focuses on copy/social trading. The broker only offers one account type, which limits flexibility if you are a seasoned trader looking for something different.

Lastly, you can only trade CFDs, so if you are looking to invest in futures, options, shares, etc., this broker is not the option for you.

- Can only trade CFDS

- Social/Copy trading platform

- One account type

- Two platforms available (Web, Mobile)

- No MetaTrader

- Spreads are not competitive

- 11 million global clients

- Able to trade forex, stocks, commodities, indices, crypto, and ETFs

FAQs

Is eToro a good idea?

Does eToro give you money?

Is eToro legal?

Is eToro a trusted platform?

About Author

Robert J. Williams

Robert J. Williams, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports.User Reviews

Be the first to review “eToro Review 2025: Is It A Trustworthy Broker?” Cancel reply

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

Review eToro: Ini Broker Legal Gak Ya?

eToro Overviews

eToro adalah platform social trading populer yang memberi akses investor ke berbagai pasar keuangan, termasuk saham, komoditas, indeks, dan mata uang. Platform ini menjadi semakin populer karena fokusnya pada social trading, memungkinkan investor untuk berinteraksi, berbagi ide dan wawasan, serta meniru trade satu sama lain. Mari kita lihat broker ini lebih detail untuk mengetahui mengapa mereka begitu populer.

eToro adalah platform social trading populer yang memberi investor akses ke berbagai pasar keuangan, termasuk saham, komoditas, indeks, dan mata uang. Platform ini menjadi semakin populer karena fokusnya pada perdagangan sosial, memungkinkan investor untuk berinteraksi, berbagi ide dan wawasan, serta meniru perdagangan satu sama lain.

eToro didirikan pada tahun 2006 dan berkantor pusat di Tel Aviv, Israel. Platform ini telah berkembang pesat dalam beberapa tahun terakhir dan sekarang memiliki lebih dari 11 juta pengguna terdaftar di lebih dari 140 negara. Itu juga sepenuhnya diatur oleh otoritas keuangan papan atas, termasuk FCA di Inggris dan CySEC di Siprus.

Salah satu manfaat utama eToro adalah platformnya yang mudah digunakan, yang dirancang agar dapat diakses oleh pedagang dari semua tingkat pengalaman. Apakah Anda seorang pemula atau trader berpengalaman, Anda akan dapat menggunakan platform ini untuk mengakses pasar keuangan, meneliti peluang investasi, dan melakukan perdagangan dengan mudah.

Salah satu fitur menonjol dari eToro adalah jaringan perdagangan sosialnya, yang memungkinkan investor terhubung satu sama lain dan berbagi informasi tentang pasar. Investor dapat mengikuti portofolio satu sama lain, mendiskusikan strategi dan ide, dan bahkan menyalin perdagangan satu sama lain. Hal ini memungkinkan pedagang untuk mendapatkan keuntungan dari pengetahuan dan pengalaman kolektif dari komunitas individu yang berpikiran sama.

eToro juga menawarkan berbagai alat dan sumber daya untuk membantu pedagang membuat keputusan investasi yang tepat. Ini termasuk bagian berita yang komprehensif, analisis pasar terperinci, dan berbagai produk investasi, termasuk saham, komoditas, dan ETF. Mari kita lihat broker ini lebih detail untuk mengetahui mengapa mereka begitu populer.

| Fitur Broker | Gambaran Umum |

| Jenis Broker | Broker CFD |

| Regulasi & Lisensi | · Australian Securities and Investments Commission (ASIC) · Cyprus Securities and Exchange Commission (CySEC) · Financial Services Authority of Seychelles (FSA) · Financial Conduct Authority (FCA) |

| Negara yang Dilayani | Link ke semua negara yang berlaku |

| Aset yang Ditawarkan | Forex, saham, komoditas, indeks, crypto, ETF |

| Platform Trading | eToro Web dan Mobile Platform |

| Kompabilitas Mobile | Ya |

| Opsi Pembayaran & Withdrawal

| · Skrill · Kartu debit dan credit · Neteller · PayPal · eToro Money · Trusty Online Banking · Transfer Bank |

Pros and Cons

- Platform yang mudah digunakan

- Sangat ramah pemula

- Dapat trading CFD

- Leverage yang dapat disesuaikan per trade

- Satu akun yang cocok untuk semua orang (bagus untuk pemula)

- Sumber daya edukasi yang bagus

- Platform yang sangat populer

- Lebih dari 11 juta pengguna

- Customer service hanya melalui tiket pengaduan

- Anda hanya dapat trading CFD

- Spread kurang kompetitif

- Hanya satu akun, tidak fleksibel

Is eToro Safe? Broker Regulations

eToro diawasi oleh empat komisi pengatur keuangan di seluruh dunia karena mereka beroperasi secara internasional di berbagai wilayah. Lebih banyak otoritas yang mengawasi broker, maka semakin baik. Artinya, mereka lebih bereputasi dan dapat dianggap lebih aman dibanding broker yang tidak diregulasi.

eToro diatur oleh dua otoritas tingkat atas, Komisi Sekuritas dan Bursa Siprus (CySEC) dan Komisi Sekuritas dan Investasi Australia (ASIC). Kemudian juga diatur oleh Financial Conduct Authority (FCA) di Inggris dan terakhir oleh Financial Services Authority of Seychelles (FSA).

Anda dapat menemukan informasi tentang peraturan mereka dengan menuju ke situs web merek, di bagian footer, di mana berbagai entitas terdaftar bersama dengan regulator dan nomor lisensi mereka;

- eToro (Europe) Ltd adalah Perusahaan Jasa Keuangan yang disahkan dan diatur oleh Komisi Bursa Efek Siprus (CySEC) di bawah lisensi # 109/10.

- eToro (UK) Ltd adalah Perusahaan Jasa Keuangan yang disahkan dan diatur oleh Financial Conduct Authority (FCA) di bawah lisensi FRN 583263.

- eToro AUS Capital Limited diberi wewenang oleh Komisi Sekuritas dan Investasi Australia (ASIC) untuk menyediakan layanan keuangan di bawah Australian Financial Services License 491139

- eToro (Seychelles) Ltd. dilisensikan oleh Financial Services Authority Seychelles (“FSAS”) untuk menyediakan layanan broker-dealer di bawah Lisensi Securities Act 2007 #SD076

Mereka telah dinominasikan sebagai program afiliasi terbaik oleh “forex-awards”. Jika Anda ingin mempertimbangkan review pelanggan dalam menentukan legitimasi broker, Anda juga dapat melihat Trustpilot. eToro memiliki review yang disematkan di situs webnya. Klien memberi broker ini peringkat 4,3 dari 5 bintang dari hampir 19.000 review pelanggan.

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority of Seychelles (FSA)

- Financial Conduct Authority (FCA)

What Can I Trade with eToro?

eToro melayani trading CFD untuk forex, saham, komoditas, indeks, dan crypto. Mereka tidak memberikan banyak informasi tentang jumlah aset yang ditawarkan, dan Anda tidak akan menemukan informasi ini di situs mereka. Anda perlu membuka halaman kuotasi pasar yang sebenarnya untuk masing-masing aset, dan kemudian Anda dapat mengetahui berapa banyak instrumen untuk setiap kelas aset yang tersedia.

Forex

Menuju ke bagian kutipan situs eToro untuk forex, kita dapat melihat bahwa mereka menawarkan 49 pasangan mata uang. Anda dapat menemukan semua minor dan major pair, bersama dengan beberapa eksotik. Daftar aset untuk forex tidak terlalu besar, tetapi mencakup apa yang biasanya ditangani oleh para trader.

Saham

Broker ini sama sekali tidak memberikan jumlah pasti. Karena itu, kami tidak dapat berspekulasi tentang berapa banyak saham yang mereka tawarkan sebagai CFD yang dapat diperdagangkan. Namun, saham paling populer, seperti Meta, Amazon, Google, dll., dapat ditradingkan.

Komoditas

Logam, energi, dan kebutuhan pokok dapat ditradingkan di eToro. Ada juga gandum, minyak, emas, perak, gas alam, dll. Anda bahkan dapat memperdagangkan Live Cattle melalui broker ini.

Indeks

Halaman kuotasi untuk indeks menampilkan 20 indeks paling populer yang melacak perusahaan di seluruh dunia. Di sini Anda dapat menemukan segalanya mulai dari DAX hingga Hang Seng, belum lagi S&P dan FTSE 100.

Crypto

eToro memiliki 57 koin berbeda yang dapat Anda perdagangkan 24/7. Trading crypto tidak seperti forex, dan pasar untuk kelas aset ini tidak pernah tutup. Semua koin populer dapat ditemukan di sini.

ETF

Terakhir, eToro juga memiliki banyak ETF yang dapat dipilih trader. ETF dapat dianggap mirip dengan kumpulan investasi yang beroperasi seperti reksa dana. eToro memungkinkan Anda memperdagangkannya sebagai CFD, dan Anda akan dapat menemukan 300 “keranjang” berbeda yang melacak berbagai sektor dari banyak ekonomi.

- Crypto

- Saham

- Forex

- Komoditas

- Indeks

- ETF

How to Trade with eToro?

Hanya ada dua cara untuk trading melalui eToro: aplikasi seluler atau platform web mereka. eToro tidak seperti broker lain yang menggunakan MetaTrader; ini mungkin bukan hal yang buruk. Saat ini, masuk ke platform berbasis web jauh lebih mudah daripada membutuhkan mesin desktop untuk menginstal program.

Namun, broker papan atas biasanya menggunakan MetaTrader karena suatu alasan. Hal ini karena dianggap sebagai standar industri sejak dirilis pada tahun 2005. Fitur dan layanan di MetaTrader adalah salah satu yang terbaik.

Platform web yang dimiliki eToro dirancang dengan baik, tetapi penting untuk dipahami bahwa platform broker ini benar-benar ditujukan untuk investor pemula dan copy trader.

Aplikasi seluler mereka dirancang khusus di platform web, dan Anda akan dapat menggunakannya seperti pada terminal web. Artinya; masih termasuk fitur copy dan social trading.

Perlu dicatat bahwa tidak banyak informasi terkait kedua platform yang diberikan, dan broker memiliki CTA bagi klien untuk mendaftar dan mencoba software mereka. Ini adalah strategi pemasaran yang cukup bagus, tetapi klien harus terlebih dahulu mendaftar untuk mendapatkan pengalaman penuh.

| Fitur | eToro Web Platform | eToro Mobile App |

| One-Click atau One-Tap Trading | Ya | Ya |

| Trade Straight off Chart | Ya | Ya |

| Email Alerts atau Push Notifications | Ya | Ya |

| Mobile Alert | Ya | Ya |

| Stop Order | Tidak | Tidak |

| Market Order | Ya | Ya |

| Trailing Stop Order | Tidak | Tidak |

| OCO Orders (One-Cancels-The-Other) | Tidak | Tidak |

| Limit Order | Tidak | Tidak |

| Trading 24 jam | Ya | |

| Charting Package | Tidak | Tidak |

| Streaming News Feed | Tidak | Tidak |

- eToro Web Platform

- eToro Mobile App

How Can I Open eToro Account? A Simple Tutorial

eToro membuat pendaftaran menjadi sangat mudah, dan ketika menuju ke situs resmi mereka; Anda akan langsung diminta dengan CTA “mulai berinvestasi”.

Jika memutuskan untuk menavigasi situs mereka, Anda harus mengklik tombol “daftar” di sisi kanan menu utama. Kedua link akan mengarahkan Anda ke halaman pendaftaran yang sama.

![]()

Setelah Anda dialihkan ke halaman pendaftaran, Anda harus mengisi nama , Email, dan kata sandi dan menerima semua syarat dan ketentuan mereka. Jika berniat untuk mendaftar dengan broker ini, maka sebaiknya Anda membaca dokumen-dokumen ini.

Anda juga memiliki opsi untuk mendaftar melalui Google atau Facebook jika Anda mau. Untuk keperluan tutorial ini, kami akan mendaftar dengan akun Email untuk menunjukkan kepada Anda langkah-langkah selanjutnya. Setelah memasukkan informasi, Anda kemudian akan diarahkan ke layar lain untuk memverifikasi Email.

Setelah memasukkan kode verifikasi dan mengklik “aktifkan sekarang”, proses pendaftaran akan selesai, dan Anda akan dibawa ke area dasbor klien, tempat Anda akan memiliki akses ke akun trading.

Pada tahap ini, meskipun proses pendaftaran sudah selesai, Anda perlu memverifikasi akun, seperti KTP, bukti alamat, dan detail perbankan. Jika Anda berencana untuk menyetor dan memulai trading, Anda harus melakukan ini.

- Buka situs web eToro

- Klik CTA atau klik tombol "daftar".

- Isi Email, username, dan password untuk mendaftar atau mendaftar melalui Google atau Facebook

- Verifikasi akun email jika mendaftar dengan kredensial email

- Masuk ke dasbor klien eToro

- Verifikasi akun untuk menyetor, berdagang, dan menarik dana

eToro Charts and Analysis

eToro memiliki sumber daya dan edukasi trading yang disusun rapi di bawah judul menu “edukasi”. Sumber daya dan materi edukasi untuk investor pemula adalah suatu keharusan bagi broker online internasional. Ini akan membantu trader dan investor baru mempelajari seluk-beluknya.

Ada empat bagian yang mencakup edukasi eToro, yaitu;

- Berita dan Analisis

- Akademi eToro

- eToro Plus

- Pahami dan Investasi

Bagian “berita dan analisis” adalah blog yang diperbarui hampir setiap hari, dan Anda dapat menemukan berita relevan yang memengaruhi pasar di sini. Mereka juga memiliki artikel yang didedikasikan secara mingguan dan artikel tentang crypto dan forex juga dapat ditemukan disini. Topik yang Anda sediakan sebagai filter meliputi, CopyTrader, Crypto, Investasi, Wawasan Pasar, Saham, Trading, dan lainnya.

Berikutnya adalah Akademi eToro, dan ini adalah sesuatu yang ingin dilihat siapa pun. Apakah Anda baru dalam trading atau profesional berpengalaman, apakah Anda menggunakan broker atau tidak, bagian Akademi diisi dengan ratusan video, podcast, dan webinar yang mencakup sebagian besar aspek trading dan pasar keuangan.

Ini benar-benar salah satu bagian Akademi terbaik yang disediakan broker, dan yang terbaik, semua konten benar-benar gratis, dan tidak ada biaya pendaftaran tersembunyi di sini.

eToro plus adalah bagian yang didedikasikan untuk ringkasan mingguan dan triwulanan yang menyelami tren pasar dan ke mana harus pergi jika Anda memerlukan gambaran keseluruhan pasar dan apa yang telah terjadi.

Ini adalah “blog” yang bagus untuk mendapatkan ringkasan yang bagus tentang kondisi pasar secara keseluruhan. Ben Laidler adalah spesialis ekonomi di sini, dan sebagian besar topik akan dibahas dan ditulis olehnya. Segala sesuatu mulai dari “dampak gas alam” hingga “covid masih menggerakkan pasar” dapat ditemukan di sini.

Bagian terakhir adalah “pahami dan investasi”, di mana seperti bagian blog dan eToro plus, Anda akan menemukan video dari para ahli yang mencakup berbagai aspek pasar. Bagian ini dapat dibandingkan dengan umpan berita “Bloomberg” tempat wawancara dapat dilakukan, wawasan tentang sektor tertentu, dan gambaran umum dibagikan.

- Berita dan Analisis

- Akademi eToro

- eToro Plus

- Pahami dan Investasi

eToro Account Types

Banyak broker memiliki jenis akun berbeda satu sama lain. Ini karena banyak orang memerlukan akun berbeda untuk gaya trading tertentu. Misalnya, beberapa broker memiliki akun “Cent” yang memungkinkan Anda trading dengan nilai pecahan, membantu menguji strategi. Anda juga terkadang mendapatkan akun “ECN” atau akun “Zero Spread” di mana spread untuk pasangan mata uang tertentu akan dimulai dari 0. Meskipun akun ini biasanya memiliki pendekatan berbasis komisi.

Dengan eToro, hanya ada satu akun. Selain itu, mereka bahkan tidak memiliki nama untuk itu, jadi ini hanya dianggap sebagai akun standar yang akan dimiliki oleh siapa pun yang mendaftar ke platform tersebut. Ini memudahkan trader baru karena sulit untuk memutuskan akun mana yang paling sesuai jika tidak memiliki pengalaman dalam trading.

Dengan eToro, satu akun cocok untuk semua. Anda juga harus ingat bahwa broker ini hanya memperdagangkan CFD. Platform dan broker umumnya didasarkan pada copy trade dan trading sosial, terutama melayani trader baru. Artinya, satu akun sangat cocok untuk semua orang, dan tidak diperlukan hal khusus.

Banyak broker juga membebankan biaya. Ini bisa untuk berbagai aspek yang mempertimbangkan berbagai fitur broker—misalnya, biaya akun tidak aktif atau biaya deposit dan penarikan. Di eToro, tidak ada biaya atau biaya tersembunyi.

Namun, ada beberapa hal yang perlu diperhatikan tentang akun tersebut. Leveragenya bervariasi, dan untuk indeks hingga 1:20. Untuk forex, leverage adalah 1:30. Spread tidak secara khusus diberikan dalam bentuk pip karena platform tidak menampilkan jenis informasi ini. Cocok untuk kemudahan bagi trader pemula. Untuk informasi tambahan tentang aset tertentu, Anda perlu membuka akun; buka aset dan klik tombol “investasi” untuk melihat semua opsi yang tersedia. Terakhir, setoran minimum untuk trading sebesar 50 USD untuk sebagian besar negara, tetapi akan bervariasi tergantung negara tempat Anda berada.

| Broker CFD | Akun Standar |

| Fitur | Satu akun untuk semua trader |

| Mata uang | USD, GBP, EUR |

| Leverage | Bervariasi |

| Deposit | 50 USD |

| Komisi Per Trade | N/A |

| Harga Desimal | N/A |

| Instrumen Trading | Forex, saham, komoditas, indeks, crypto, ETF |

| Min. Lot Per Trade | N/A |

| Max. Lot Per Trade | N/A |

| Spread | Variabel |

| Akun Demo | Ya |

| Swap/Rollover Free | Ya |

| Hedging | Tidak |

| Scalping | Ya |

| Copy Trading Support | Ya |

| Melayani warga AS | Ya (bitcoin) |

- Standard account (For all traders)

Do I Have Negative Balance Protection with This Broker?

Jika ekuitas Anda menjadi negatif, eToro akan menerapkan margin call dan menutup posisi Anda. Mereka kemudian akan menanggung kerugian yang mungkin Anda alami dan mengatur ulang saldo Anda menjadi nol. Ini berarti Anda tidak akan pernah kehilangan lebih dari apa yang Anda setorkan ke akun.

Informasi mengenai kebijakan yang dimiliki eToro ini dapat ditemukan di sini. Ini adalah kebijakan yang baik untuk dimiliki dan merupakan standar bagi banyak broker internasional (terutama broker “terkenal”). Ini membantu memberi insentif kepada calon klien agar tidak terlalu stres saat trading dan mempelajari cara melakukannya.

- Ya, mereka menawarkan perlindungan saldo negatif

eToro Deposits and Withdrawals

Ada beberapa opsi untuk menyetorkan dana ke akun Anda dalam hal metode. penawaran eToro;

- Kartu kredit atau debit

- Transfer Bank

- Klarna/Sofort

- E-wallet (PayPal, Skrill, Neteller)

- eToro Money

- Trusty Online Banking

Anda harus memverifikasi akun Anda terlebih dahulu setelah mendaftar. Setelah Anda melakukan ini, Anda akan dapat menyetor dana melalui dasbor klien. Juga, setoran PayPal tidak akan tersedia setelah setoran awal Anda melalui metode lain.

Deposit minimum untuk sebagian besar negara adalah 50 USD, tetapi ini akan berubah tergantung wilayah Anda. Referensi gambar di bawah ini untuk perincian lengkap.

Metode penarikan sama dengan penyetoran, dan Anda akan menemukan opsi ini yang juga terletak di dasbor klien Anda di menu.

eToro tidak mengenakan biaya akun dan juga tidak ada untuk penyetoran dan penarikan. Ini juga merupakan kebijakan yang dimasukkan sebagian besar broker. Namun, beberapa menggunakan pemasaran untuk mendorongnya sebagai penawaran promosi ketika dianggap sebagai praktik standar oleh sebagian besar broker.

- Minimum deposit sebesar 50 USD

- Skrill

- Kartu kredit atau debit

- Neteller

- PayPal

- eToro Money

- Trusty Online Banking

- Transfer Bank

Support Service for Customer

eToro tidak unggul dalam Customer Support. Namun, terdapat pusat bantuan di mana Anda dapat membuka tiket sebagai pelanggan mereka. Anda dapat menemukan Pusat Bantuan dengan membuka menu atau dengan menggulir ke bawah ke bagian footer.

Untuk membuka tiket, Anda harus menuju ke Pusat Bantuan dan mengklik link “layanan pelanggan”. Anda kemudian akan dialihkan ke halaman baru tempat Anda dapat membuka tiket CS baru.

Selain Pusat Bantuan yang diisi dengan bagian FAQ yang cukup lengkap, tidak ada saluran lain untuk menjangkau customer support. Biasanya, broker yang lebih bereputasi akan memiliki banyak pilihan CS, termasuk live chat, telepon, Email, formulir kontak, dan banyak lagi.

eToro sangat kekurangan dalam bidang customer support, dan sejauh ini kami belum mengalami masalah apa pun dengan broker ini, jadi kami tidak dapat mengetahui waktu penyelesaian tiket untuk diselesaikan.

| Customer Support eToro | Gambaran Umum |

| Bahasa | Inggris, Ibrani, dan Spanyol |

| Customer Service oleh | eToro |

| Jam Customer Service | Unknown |

| Email Response Time | N/A |

| Telepon CS | Tidak |

| Personal Account Manager | Tidak |

- Bahasa: Inggris, Ibrani, dan Spanyol

- Saluran Customer Support: FAQ Pusat Bantuan, Tiket

- Jam Layanan Pelanggan: Tidak diketahui

Prohibited Countries: Where Can I Not Trade with this Broker?

Daftar negara yang tidak diperbolehkan menggunakan eToro sangat luas dan terlalu panjang untuk dicantumkan di sini. Karena berbagai alasan, broker mungkin tidak diizinkan beroperasi di wilayah tertentu. Ini berarti bahwa jika Anda adalah bagian dari daftar negara yang “dilarang”, Anda tidak akan diizinkan untuk menggunakan broker dan trading. Namun, Anda dapat menemukan informasi tentang negara yang diblokir di sini.

Selain itu, Anda dapat menemukan informasi tentang negara yang dilayani oleh eToro di sini. Ingat, undang-undang, peraturan, dan sanksi memainkan peran besar dalam apakah broker akan beroperasi di suatu wilayah atau tidak, jadi ini adalah salah satu hal pertama yang perlu Anda pertimbangkan saat mencarinya.

- Untuk informasi lengkap, lihat link di atas

Special Offers for Customers

eToro tidak menawarkan bonus tambahan atau promosi khusus saat Anda mendaftar. Berbagai broker akan menawarkan serangkaian promosi khusus seperti welcome bonus, program loyalitas, program IB, hadiah pelanggan, hadiah, dan sebagainya. eToro tidak memiliki yang seperti ini.

Satu-satunya aspek promosi yang mereka miliki adalah link rujukan yang dapat Anda kirim ke teman dan keluarga Anda, dan mereka dapat menggunakannya untuk mendaftar ke broker. Namun, biasanya akan ada beberapa insentif seperti potongan harga atau biaya tetap jika mereka bergabung dan mendaftar. eToro juga tidak memiliki ini. Mereka hanya memberi Anda link rujukan dan tidak ada informasi tentang kompensasi apa pun yang mungkin Anda terima.

Namun, Anda harus mempertimbangkan bahwa eToro pada dasarnya adalah platform copy trading tanpa biaya. Ini berarti bahwa tidak ada biaya pendaftaran atau biaya apa pun untuk penyetoran dan penarikan. Selain itu, mereka tidak mengambil komisi saat Anda menyalin portofolio trader lain.

Pada dasarnya ini berarti Anda dapat menyalin investor yang melihat pengembalian 300%, dan dengan mengklik tombol, Anda akan mengikuti semua posisinya. Di satu sisi, ini memang tampak seperti “promosi khusus”.

- Tidak ada penawaran khusus

- Copy Trading

eToro Review Conclusion

eToro telah beroperasi sejak 2006 dan memiliki 11 juta pengguna di seluruh dunia. Berbagai otoritas keuangan juga mengaturnya di seluruh dunia. Mereka memiliki hampir 15.000 review positif di Trustpilot.

PIPPENGUIN

eToro telah beroperasi sejak 2006 dan memiliki 11 juta pengguna di seluruh dunia. Berbagai otoritas keuangan juga mengaturnya di seluruh dunia. Mereka memiliki hampir 15.000 ulasan positif di Trustpilot.

Mempertimbangkan faktor-faktor ini dan mempertimbangkan semua poin lain yang kami sampaikan dalam artikel ini, kami harus mengatakan bahwa eToro adalah broker yang legal dan aman.

Summary and Key Takeaways

Platform eToro simpel dan mudah digunakan, termasuk platform web dan seluler. Cocok bagi trader pemula yang terutama berfokus pada copy/social trading. Broker hanya menawarkan satu jenis akun, yang membatasi fleksibilitas jika Anda seorang trader berpengalaman yang mencari sesuatu yang berbeda.

Terakhir, Anda hanya dapat trading CFD, jadi jika Anda ingin berinvestasi di futures, opsi, saham, dll., broker ini bukanlah pilihan terbaik untuk Anda.

- Hanya dapat trading CFD

- Platform copy trade / social trade

- Satu jenis akun

- Tersedia dua platform (Web, Seluler)

- Tidak ada MetaTrader

- Spread tidak kompetitif

- 11 juta klien global

- Mampu trading forex, saham, komoditas, indeks, crypto, dan ETF

About Author

User Reviews

There are no reviews yet.

Be the first to review “Review eToro: Ini Broker Legal Gak Ya?” Cancel reply

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

- eToro Overviews

- Pros and Cons

- Is eToro Safe? Broker Regulations

- What Can I Trade with eToro?

- How to Trade with eToro?

- How Can I Open eToro Account? A Simple Tutorial

- eToro Charts and Analysis

- eToro Account Types

- Do I Have Negative Balance Protection with This Broker?

- eToro Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- eToro Review Conclusion

- Summary and Key Takeaways

- FAQs

- About Author

There are no reviews yet.