Is it a Reliable Broker?

Versus Trade Overviews

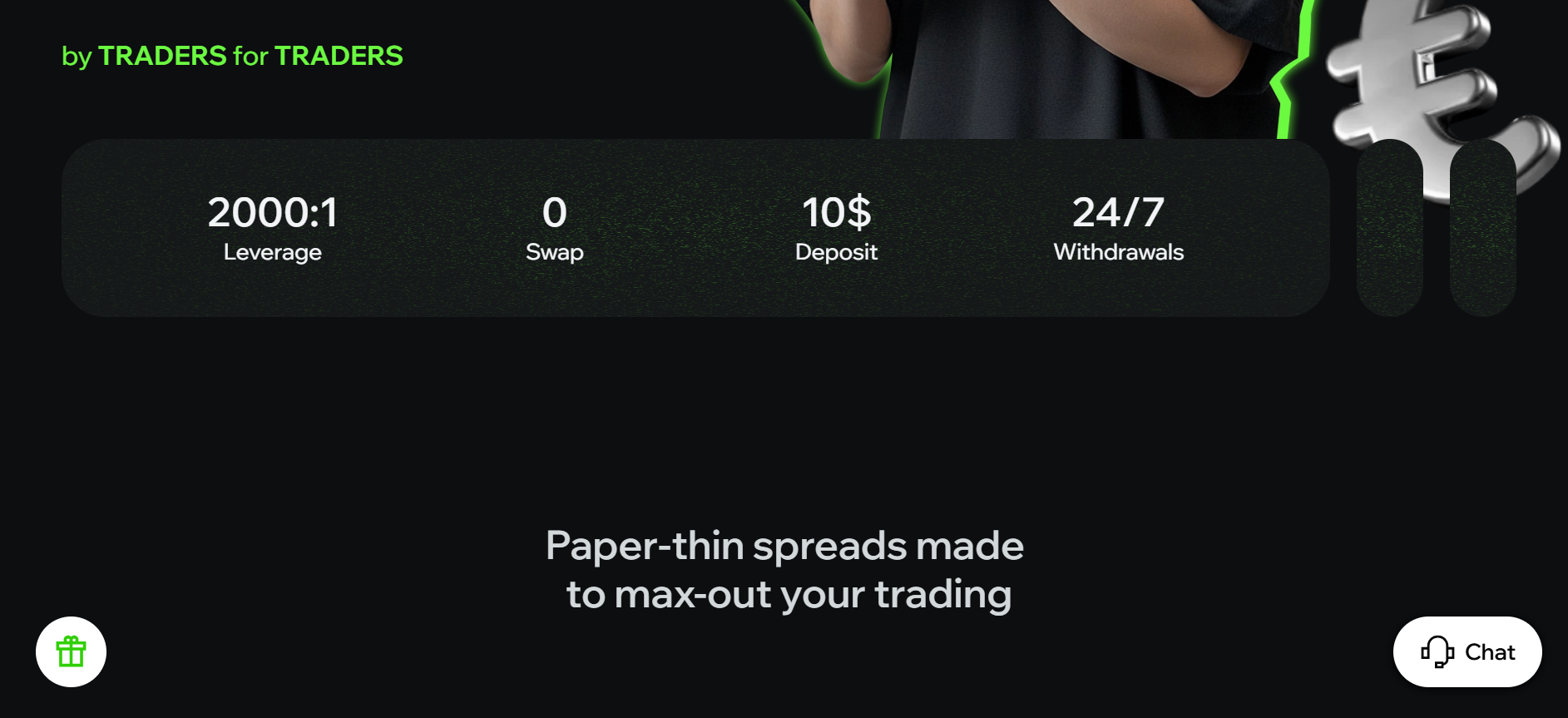

Versus Trade is a modern CFD broker launched in 2024 and registered in Saint Lucia. It offers trading across 200+ instruments—including forex, cryptocurrencies, stocks, commodities, indices, and innovative "Versus Pairs" (e.g., Bitcoin vs Gold)—all on MetaTrader 5. With a low $10 minimum deposit, high leverage (up to 1:2000), swap-free/Islamic accounts, and 24/7 multilingual support, it appeals to active and cost-conscious traders. However, its lack of regulatory oversight remains a notable concern.

Versus Trade is a modern CFDs broker founded in 2024 and registered in Saint Lucia. It specializes in online multi-asset trading via the MetaTrader 5 platform. The broker’s signature offering is its “Versus Pairs” – innovative cross-asset CFDs (e.g. Tesla vs Ford, BTC vs Gold) that let traders speculate on the relative performance of two assets.

Pros and Cons

- Very low minimum deposit of $10 with no deposit, withdrawal, or inactivity fees

- High leverage up to 1:2000 allowing aggressive strategies

- Islamic swap-free mode enabled by default for eligible instruments and regions

- Fast MT5 execution with ECN/STP model, minimal slippage, supports scalping, hedging, and automated trading

- Innovative Versus Pairs CFDs like BTC vs Gold and Amazon vs Alibaba

- 24/7 multilingual customer support above industry average

- Quick and simple registration with KYC often completed within ~10 minutes

- Not regulated by any Tier-1 authority

- Lacks proprietary education or research resources and has no integrated news or economic calendar

- No social trading, PAMM, or advanced in-house analytics

- MT5-only access with no proprietary platform or webtrader

Is Versus Trade Safe? Broker Regulations

Versus Trade is now on final stages of obtaining FSC lisence on Mauritius and is officialy registered in Saint Lucia. This provides a basic level of oversight but does not offer the stringent protections of regulators.

Despite lighter regulation, Versus Trade does take client fund safety measures. It claims to keep client deposits in segregated bank accounts (at multiple tier-1 banks) separate from company capital. It also advertises Negative Balance Protection (NBP) for retail clients: in volatile markets, traders cannot lose more than the funds in their account. This NBP applies automatically to qualifying accounts and prevents balances from going negative. Standard KYC (ID and proof of address) and AML checks are enforced before trading. Data security is via industry-standard encryption (SSL/TLS) for the trading portal. In summary, Versus Trade has a strong fund protection (segregation, NBP) but lacks higher-tier regulatory oversight, so traders should weigh this when assessing safety.

How to Trade with Versus Trade?

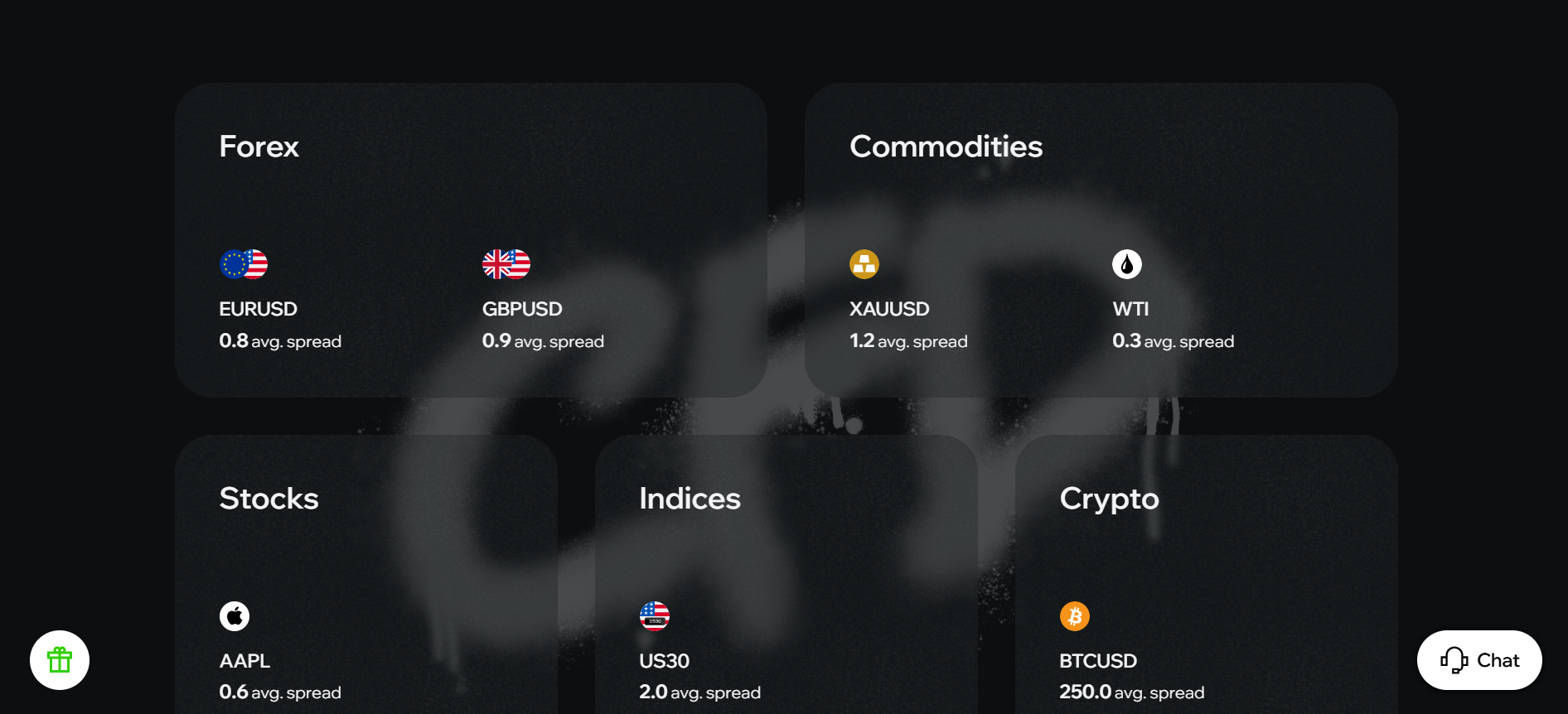

Versus Trade offers a wide variety of CFD asset classes, though some categories are modest in size. In total there are over 200 instruments available. This includes roughly 75+ Forex pairs (majors, minors and exotics). Major currency pairs (EUR/USD, GBP/USD, etc.) are well covered, with micro-lot (cent) trading possible. The broker provides cryptocurrency CFDs on leading coins (e.g. BTC/USD, ETH/USD, XRP/USD), allowing 24/7 crypto exposure. It also offers stock index CFDs (e.g. US500, NAS100, DAX30, FTSE100) and metals/commodities (Gold, Oil, Natural Gas). Traders can access stock CFDs from major markets including the US, Europe, and Asia, with a carefully selected list of around 57 symbols covering leading companies.

The standout category is the broker’s proprietary Versus Pairs instruments. These are cross-asset CFDs combining two assets into one trade (for example, Tesla vs Ford, Bitcoin vs Gold or Amazon vs Alibaba). This format lets traders express relative performance views, which can be useful in volatile markets. In total Versus Trade offers 12 such Versus Pairs, covering various sectors. Apart from these, no fixed-income (bonds) or ETF CFDs are provided, and no options or futures. All trading is in CFD form.

Finally, account holders have access to standard markets like commodity CFDs and indices in addition to forex and crypto. The exact availability of some instruments may depend on account type. Overall, Versus Trade covers the essential classes (FX, crypto, indices, commodities, stocks) with competitive breadth, and differentiates itself via Versus Pairs. Traders interested in cross-asset stretegies or high-leverage forex will find plenty of opportunities, especially with Versus Pairs CFDs that let trade asset-against-asset in a single position, a unique format that goes beyond traditional instruments.

How To Trade?

Trading with Versus Trade is done exclusively through the MetaTrader 5 (MT5) platform, which is available for desktop, web, and mobile devices. The process involves setting up your account, placing trades, and managing open positions using the tools available on MT5. Traders can use advanced order types, apply technical indicators, and even run automated strategies to suit different trading styles. Below is a step-by-step breakdown of how to get started.

How Can I Open Versus Trade Account? A Simple Tutorial

-

Visit the official Versus Trade website and click “SIGN UP.”

-

Select your country of residence and agree to the client agreement, privacy policy, and AML terms.

-

Enter your email address and choose a password to create your account.

-

Verify your email address via the confirmation link sent to your inbox.

-

Log in to the client dashboard, where your new account is instantly created.

Versus Trade Charts and Analysis

Versus Trade relies on the powerful MetaTrader 5 platform for all charting and analysis. MT5 provides multiple chart types (candlesticks, bars, lines, Heikin-Ashi, tick charts, etc.) across 21 timeframes (from 1-minute up to monthly). Traders can apply a wide range of drawing tools (trend lines, channels, Fibonacci retracements, shapes) directly on the chart, and choose from dozens of built-in technical indicators (MT5 has 80+ for trend, momentum, volatility, etc.). For developers, MT5 allows coding or importing custom indicators and Expert Advisors for automated trading. All chart analysis is done in real-time with market data, and historical backtesting is supported via the strategy tester.

Versus Trade Account Types

| Account Type | Min. Deposit | Spreads (from) | Commission | Leverage | Execution | Instruments Access | Platforms | Eligibility/Notes |

| Standard | $10 | 0.2 pips | $0 (spread-only) | 1:2000 | ECN/STP | All offered instruments | MT5 | No swap fees; available to most assets all automatically |

| Cent | $10 | 0.4 pips | $0 (spread-only) | 1:2000 | ECN/STP | Forex, Metals | MT5 | For new traders/EA testing |

| Pro | $100 | 0.1 pips | $0 (spread-only) | 1:2000 | ECN | All instruments | MT5 | Lower margin call, advanced tools |

| Raw Spread | $100 | 0.0 pips | $3 per side per lot | 1:2000 | ECN | All instruments | MT5 | Tightest spreads, scalper-friendly |

| Islamic | $10 | 0.4 pips | $0 (spread-only) | 1:2000 | ECN/STP | All (swap-free on eligible) | MT5 | Automatic for Islamic clients |

| Swap-free | – | Same as account | $0 (spread-only) | 1:2000 | ECN | Major, Minors, Commodities, All Versus Pairs, All Cryptocurrencies, All Indexes | MT5 | No swap fees; available to most assets automatically |

| Demo | $0 (virtual) | Same as Standard | $0 | 1:2000 | ECN/STP | All instruments (virtual) | MT5 | For practice and platform familiarization |

Each account type uses the MT5 platform. All support the full range of assets and optional swap-free modes (Standard/Cent accounts automatically go swap-free in certain countries).

Do I Have Negative Balance Protection with This Broker?

Yes. Versus Trade provides Negative Balance Protection (NBP) to retail clients. This means that in volatile market conditions, a trader’s account balance cannot go below zero – the broker will cover any losses beyond the client’s equity. Effectively, you cannot lose more money than you have deposited. NBP is applied to all standard retail accounts (including Standard, Pro, Raw, etc.). In practice, if a client’s position would otherwise cause the account to dip negative (for example in a flash crash), Versus Trade will liquidate positions to bring the balance to exactly zero rather than below. This acts as a safeguard for retail clients against margin calls in extreme swings. (Professional or institutional accounts may not have NBP by default, following general industry rules.)

Versus Trade Deposits and Withdrawals

Versus Trade supports a wide range of payment methods in both fiat and cryptocurrency. You can deposit or withdraw via bank cards (Visa/MasterCard), bank wires (local bank transfers in USD/THB/IDR/MYR/VND), popular regional e-wallets (e.g. TrueMoney, DANA, OVO, MOMO) and cryptocurrencies (Bitcoin, Ethereum, USDT, USDC, XRP, TRX, BNB-BEP20, LTC, etc.).

Support Service for Customer

Versus Trade’s customer service operates around the clock. The broker advertises 24/7 support via multiple channels. Specifically, the live chat on the website is available in eight languages (English, Chinese, Thai, Malay, Bahasa Indonesia, Arabic, Vietnamese, Russian), which is more extensive language coverage than many global brokers. Email support (support@versus.trade) is also offered, along with responses on social media (Facebook, Instagram).

Prohibited Countries: Where Can I Not Trade with this Broker?

Versus Trade explicitly excludes residents of the United States from its services. In fact, it does not accept clients from the USA, Canada, United Kingdom, some European Union, Russia, Belarus, North Korea, Iran, Myanmar (Burma), and other jurisdictions where offering CFD trading would violate local laws.

Special Offers for Customers

Versus Trade Ltd is running the “Celebrate Merdeka with Versus Trade – $3,000 Lucky Draw”, available exclusively to Malaysian clients from August 1, 2025, to August 31, 2025. Eligible clients with verified accounts who trade on XAUUSD (Gold vs USD) can participate by earning lucky draw tickets—1 ticket for every 1 lot traded, with no cap on the number of tickets. The promotion features a $3,000 prize pool, distributed among 30 winners, with rewards of $500 (1 winner), $300 (2 winners), $200 (3 winners), $100 (4 winners), and $45 (20 winners).

Versus Trade Review Conclusion

However, there are key limitations. Crucially, Versus Trade is not regulated by any top-tier authority (only St. Lucia’s FSRA), so clients must accept higher counterparty risk.

Summary and Key Takeaways

- Versus Trade is an online broker that provides access to forex, commodities, indices, cryptocurrencies, and unique Versus Pairs through the MetaTrader 5 (MT5) platform, available on desktop, web, and mobile.

About Author

Richard Johnson

Robert is a senior editor for PipPenguin. He holds both an MBA and a Bachelors Degree from the University of Southern California. Alongside his work for PipPenguin, he also writes for Globe Investement Balt Investment. Outside of work, he enjoys reading non fiction and trading forex.

- Versus Trade Overviews

- Pros and Cons

- Is Versus Trade Safe? Broker Regulations

- How to Trade with Versus Trade?

- How Can I Open Versus Trade Account? A Simple Tutorial

- Versus Trade Charts and Analysis

- Versus Trade Account Types

- Do I Have Negative Balance Protection with This Broker?

- Versus Trade Deposits and Withdrawals

- Support Service for Customer

- Prohibited Countries: Where Can I Not Trade with this Broker?

- Special Offers for Customers

- Versus Trade Review Conclusion

- Summary and Key Takeaways

- About Author